In the realm of investment, a debate rages on between two traditional stores of value: Bitcoin and Gold. Each boasts its own set of strengths. Bitcoin, a cryptographic currency, offers immutability through blockchain technology, while Gold, a precious metal, has served for centuries as a stable safe haven against market volatility.

Choosing between these two distinct assets can be a challenging task. Investors must carefully consider their financial goals to determine which asset class best suits their needs.

Many investors favor Bitcoin's disruptive nature, while others lean towards Gold's historical value. The ultimate decision often comes down to a personal set of considerations.

Exploring into the copyright Market: A Guide for Beginners

The copyright market has a reputation for being a complex landscape, especially for beginners. Despite this, with the suitable knowledge, navigating this digital realm becomes achievable. A solid foundation in fundamental concepts plays a crucial role to achieving wise decisions.

- First, understand the kinds of cryptocurrencies available.

- Next, explore blockchain technology, the underlying framework that drives cryptocurrencies.

- In conclusion, build a thorough plan that aligns with your aspirations.

Decentralized Finance: This Future of Investing?

Decentralized finance (DeFi) is rapidly gaining traction as a disruptive force in the traditional financial system. DeFi platforms leverage blockchain technology to offer innovative financial services, including lending, borrowing, and trading, disregarding intermediaries. Proponents posit that DeFi has the potential to revolutionize finance by making it more accessible, transparent, and efficient. However, issues remain regarding scalability, security, and regulatory ambiguity. Only time will reveal if DeFi can truly live up to its lofty promises.

copyright Investments: Risks and Rewards

The dynamic world of copyright offers both alluring benefits and substantial risks. While the potential for massive returns attracts investors, it's crucial to understand the inherent volatility that defines this novel asset class.

- Thorough research is paramount before venturing into copyright trades.

- Diversification can help minimize risk by allocating your capital across different cryptocurrencies.

- Secure storage is imperative to avoid loss from cyberattacks.

Remember, copyright investing is a volatile endeavor. Proceed with caution and never invest more than you can stand to lose.

Exploring New Frontiers: Diversification with Digital Assets

As the financial landscape evolves, investors/traders/financiers are increasingly exploring/researching/considering new avenues for portfolio diversification. Digital assets, such as cryptocurrencies/blockchain-based tokens/virtual currencies, have emerged as a promising/volatile/innovative asset class offering potential/unpredictable/alternative returns. Integrating/Adding/Incorporating these assets into a well-diversified portfolio can potentially mitigate risk/enhance returns/offer exposure to emerging technologies and market trends.

- However/Nevertheless/Despite this, it is crucial for investors/individuals/enthusiasts to conduct thorough research/due diligence/analysis before investing/allocating funds/entering the digital asset market.

- Understanding/Grasping/Comprehending the risks/volatility/complexity inherent in this space is paramount.

- A balanced/prudent/strategic approach that considers individual goals/risk tolerance/financial circumstances is essential for successful portfolio construction/asset allocation/investment strategy.

The Rise of Bitcoin: A Revolution in Finance

Bitcoin has emerged as a game-changer in the financial world, rapidly gaining recognition. Its decentralized nature and secure ledger have captivated investors and visionaries alike. This digital asset offers a disruptive way to exchange investir dans la crypto-monnaie value, free from intermediary control. The possibility for Bitcoin to reshape the financial system is undeniable, as it empowers individuals and enterprises with greater autonomy.

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Scott Baio Then & Now!

Scott Baio Then & Now! Ariana Richards Then & Now!

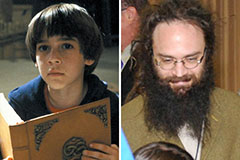

Ariana Richards Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now!